IRS Reporting: Helpful Resources for Employers

IRS Regulations (selected information, courtesy IRS.gov)

For 2015 and after, employers employing at least a certain number of employees (generally 50 full-time employees or a combination of full-time and part-time employees that is equivalent to 50 full-time employees) will be subject to the Employer Shared Responsibility provisions under section 4980H of the Internal Revenue Code (added to the Code by the Affordable Care Act). As defined by the statute, a full-time employee is an individual employed on average at least 30 hours of service per week. An employer that meets the 50 full-time employee threshold is referred to as an applicable large employer (ALE).

Form 1095-C is filed and furnished to any employee of an ALE member who is a full-time employee for one or more months of the calendar. ALE Members must report that information for all twelve months of the calendar year for each employee.

MORE FROM THE INTERNAL REVENUE SERVICE

COMPLETING THE FORMS

In order to be compliant, each full-time employee that was employed at any time during the year must receive a 1095-C. Additionally, these forms are summarized on the 1094-C transmittal form that goes to the IRS with a copy of the returns. For employers with more that 250 employees, the data must be sent to the IRS electronically.

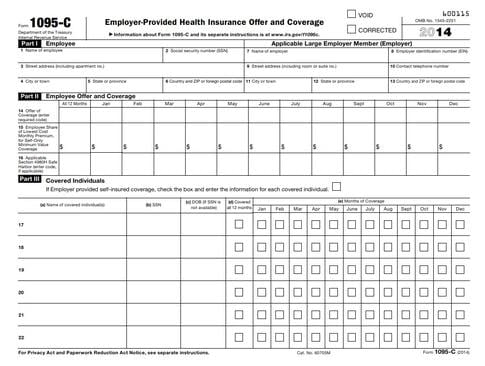

See below for some education about the 1095-C and 1094-C. We will start with the 1095-C.

A full-size sample Form 1095-C can be found here.

THE 1095-C

This one-page form has three main sections:

- Part I, for Employee and Employer demographic information

- Part II, Employee Offer and Coverage - this is a breakdown of coverage offered, enrolled, and cost by calendar month

- Part III, for self-insured plans only, an itemization of other covered individuals (i.e.spouse and family); fully-insured employers will only complete Parts I and II, with Part III completed by the issuer or plan sponsor.

Part II contains the data used by the IRS to calculate tax penalties related to the Employer Mandate, displayed on 3 rows:

- Row 14, Offer of Coverage

- Row 15, Employee Share of Lowest Cost Monthly Premium, for Self-Only Minimum Value Coverage

- Row 16, Applicable Section 4980H Safe Harbor

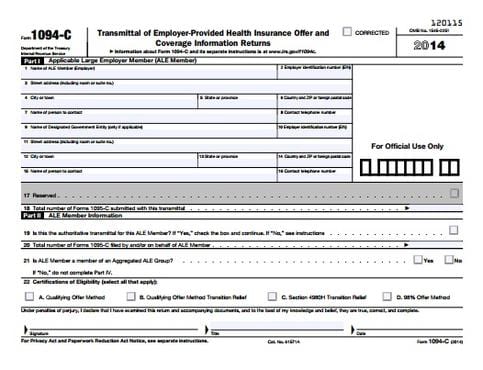

The 1094-C

This summary form is a three page document that is sent with the individual 1095-C packet, and is divided into four sections:

- Part I, Employer demographic information

- Part II, Summary of 1095-C information

- Part III, Detail of monthly coverage and employee counts

- Part IV, for aggregated groups only, and itemization of other employers that are in the group

Part II has some very important aspects:

- While an employer may sent multiple batches of 1095-C and 1094-C, there must be a single "Authoritative Transmittal" that displays the total number of 1095-C that are filed for that employer

- If an employer is not part of an Aggregated Group, select "No" and skip part IV.

- Line 22, Certifications of Eligibility - these special sections may be available to an employer, and can help reduce record-keeping and/or avoid penalties that may otherwise have been enforced:

- Box A: Qualifying Offer Method - if an employer makes an offer of coverage of MEC/MV to it's full-time employees, plus MEC to spouse and dependents, at a cost less than 9.5% of the Federal Mainland Single Poverty Level, for the entire year, THEN Row 15 of the 1095-C may be skipped and alternative documents may be provided to the employee (although the 1095-C is still due to the IRS)

- Box B: Qualifying Offer Method Transition Relief - similar to the above, but the option is available if the Qualifying Offer was not made for all 12 months of the year but at least part of the year

- Box C: Section 4980H Transition Relief - to ease the transition, the IRS will either A) not enforce penalties if employer has 50-99 employees, or B) reduce penalties for those with 100+ employees

- Box D: 98% Offer Method - if employer offers affordable/MEC/MV coverage to at least 98% of its employees, then Part III, column (b) may be omitted

Part III has rows for either All 12 Months, or each month if there are differences, asking:

- (a) Y/N: If Minimum Essential Coverage was offered to at least 95% of full-time employees and dependents

- (b) The count of full-time employees

- (c) The count of total employees

- (d) Y/N: if employer was a member of an Aggregated Group

- (e) If Part II, Line 22, Box C was checked, whether the 4980H relief was available through Indicator A or Indicator B

Part IV, as mentioned before, is completed only if Part II, Line 21 was completed as "Yes".

A full-size sample Form 1094-C can be found here.

HELP IS AVAILABLE

Don't get lost in details, and don't waste your time becoming experts in IRS forms. Let 1095EZ Online take care of it!